Timing Pundit Market Timing Signals

Last Update: 10-29-2024

All analysis on this page is based on Out Of Sample data, not In Sample which produces over optimistic results.

Register Today

- No credit card needed.

- See current signal and up to date trades. You can view the rest of the site without registering

- You may select email notifications or just access to the signal.

- Your email will not be shared.

Signal Explanation

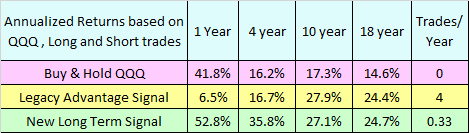

The Advantage signal worked well for a number of years. Changing market dynamics since 2021 have hurt its performance. I set out to make a new model that traded less but would avoid the major bear markets. Hence, the Long Term signal was born. Think of it as an augmented Buy & Hold strategy.

The Advantage signal is a trend following system that can also detect some of the peaks and troughs. It does well in a trending market but not so much in a choppy market. It could still work well if this market starts trending.

The Long Term signal is not a trend following system. There are no moving averages or pattern recognition. It monitors the correlation between NDX and VXN which is the NASDAQ volatility index. And it monitors market breadth as measured by the percent of NASDAQ Comp stocks above their 200 day moving average. VXN is calculated from option data, not price volatility. Normally NDX and VXN go in opposite directions. They are negatively correlated. As major market tops form, the correlation usually turns positive. VXN starts rising as NDX goes higher and higher. Fund managers are buying Puts for portfolio protection for one thing.

If the positive correlation gets high enough and market breadth is in the right range, a sell signal is issued. There have only been 7 signals since 2006. One of those was 10/31/2007, the market top to the day before the Great Financial Crisis. Another one was 11/17/21, 3 days before the market top before the 2022 bear market. Both signals stayed out until after the bottom was in. The other 5 signals were short false starts which were still profitable. The Advantage signal generated 54 sell signals in the same time frame with a 63% win rate. the Long Term signal had a 93% win rate.

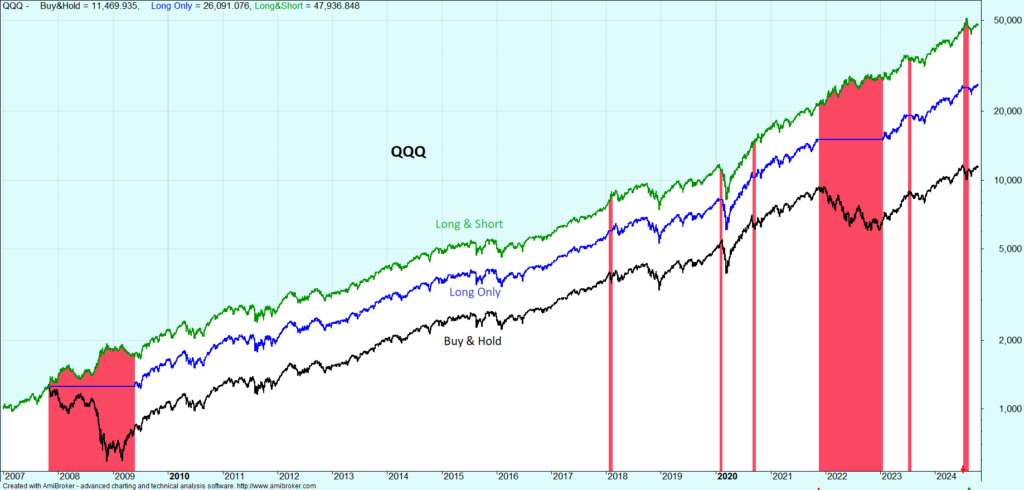

Long Term Signal Equity Curve

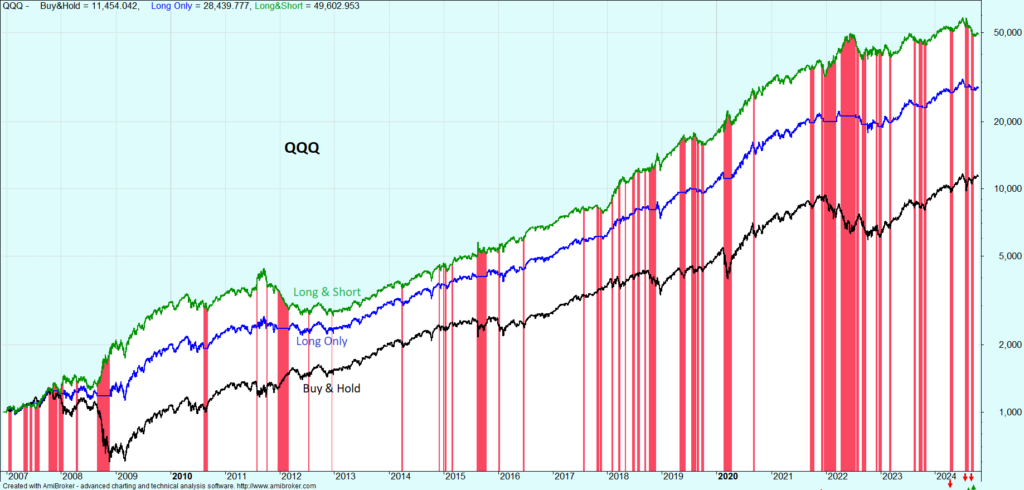

Advantage Signal Equity Curve

Both signals make about the same profit but the Long Term equity curve is so much smoother and straight.

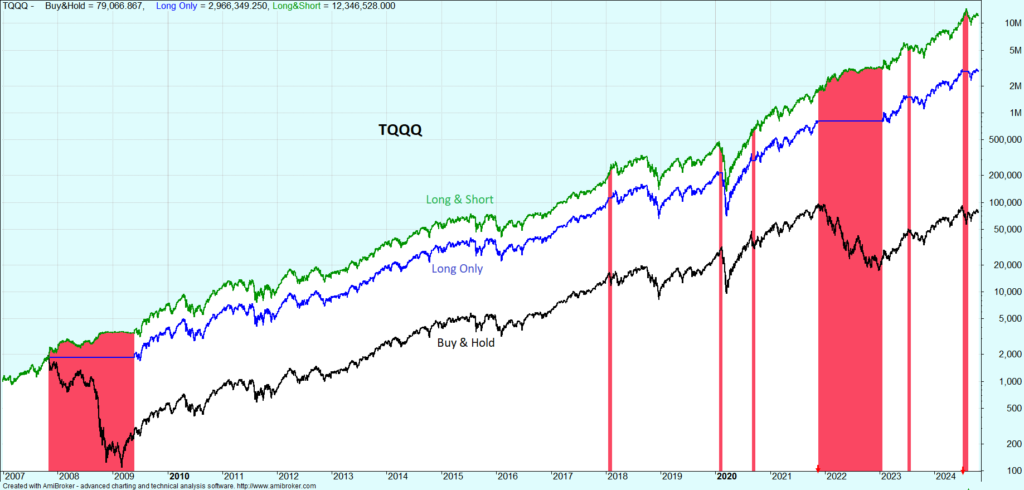

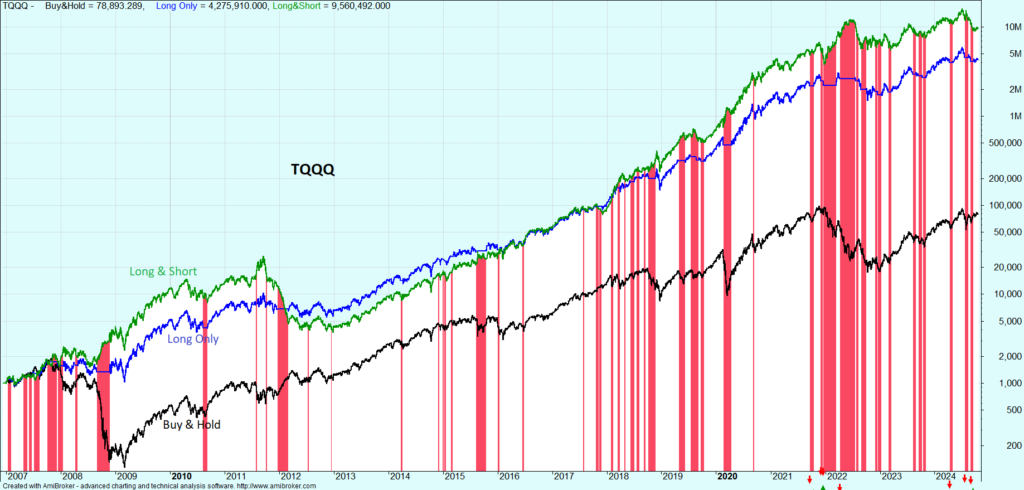

Now do it with TQQQ

test