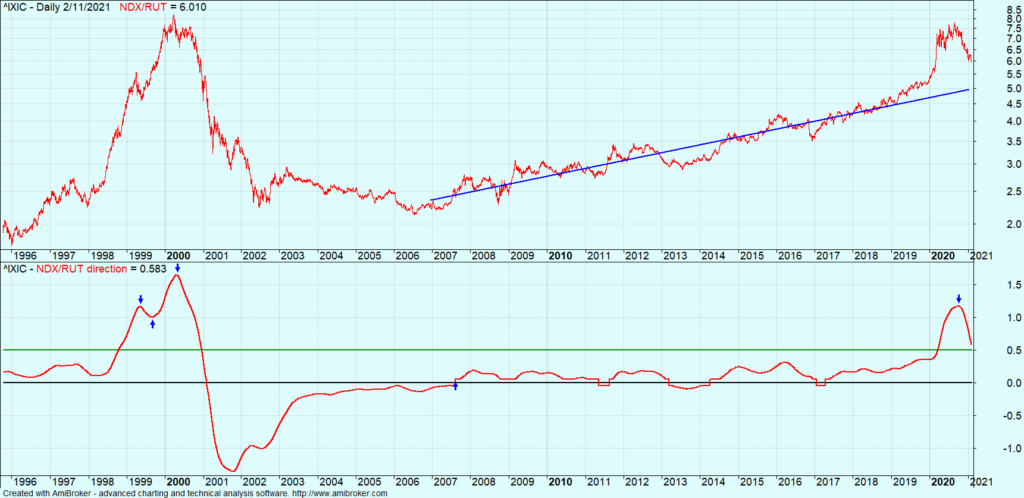

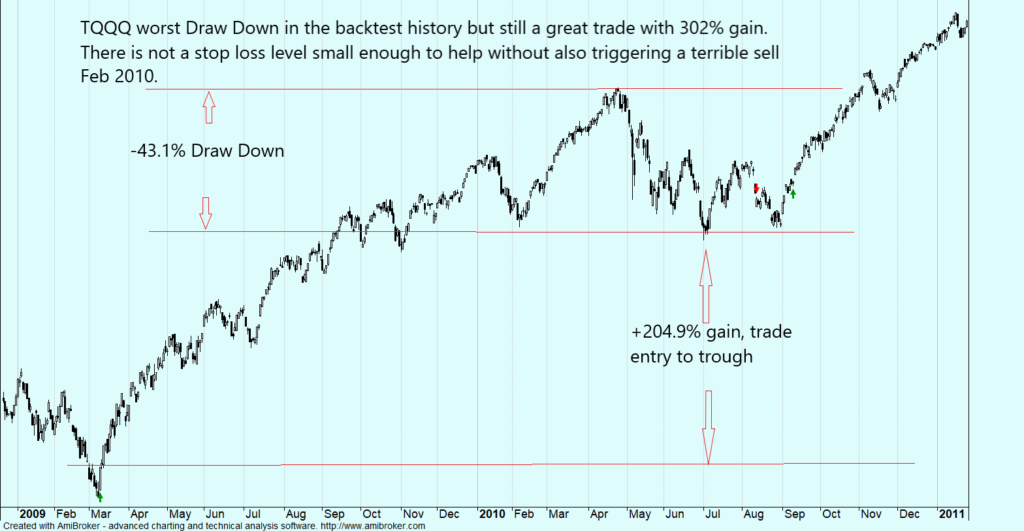

Market Rotation to Small Caps Update

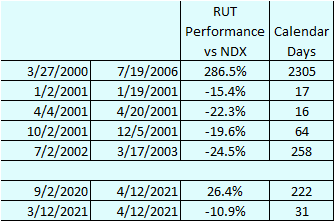

The strong performance of small caps that started last year continues. YTD IWM is up 15.26%, QQQ only 6.94%. Leveraged URTY is up 50.29%, and TQQQ is up 20.12%. In the Russell 2000, 32% of the components are up over 20%, more than all of 2020.

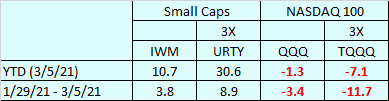

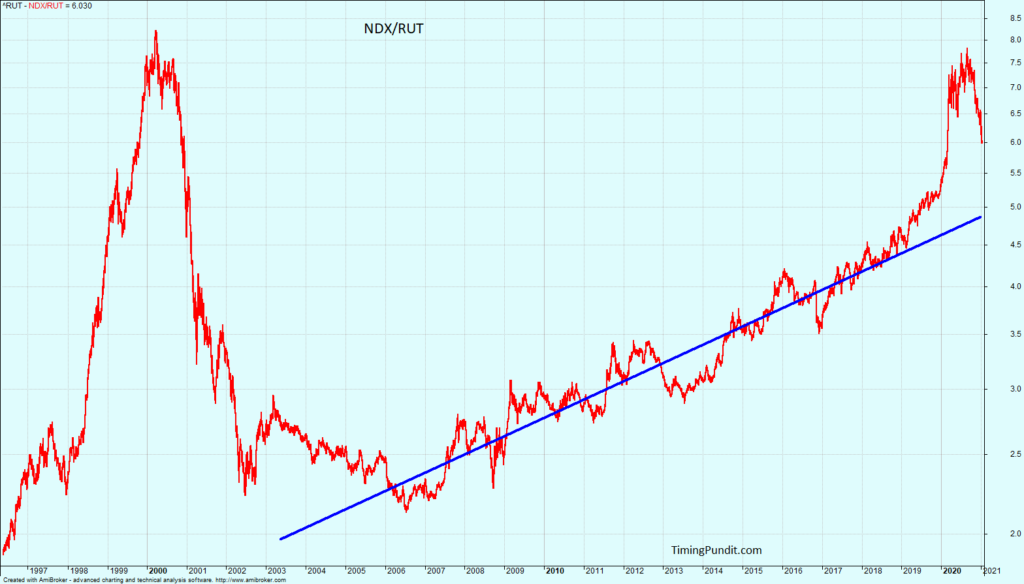

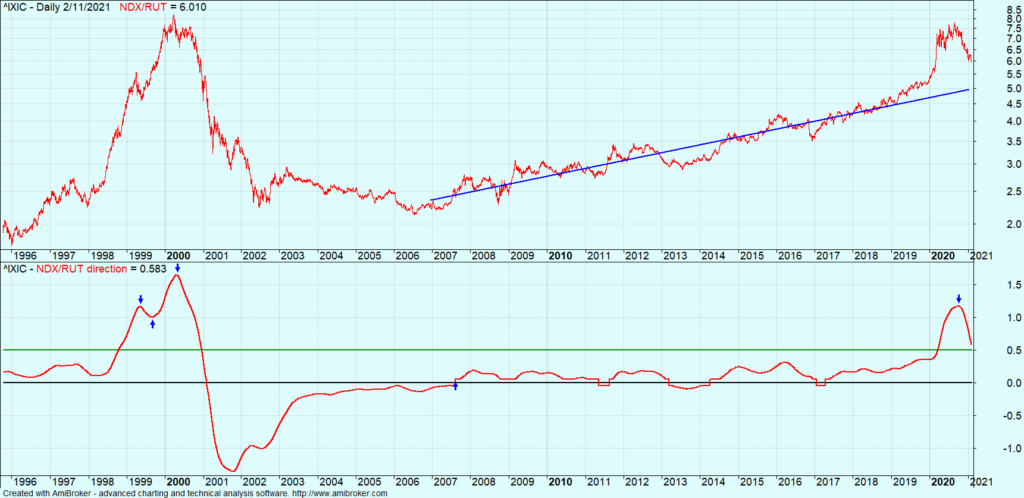

The following graph is an update of the NDX/RUT ratio and the indicator I created to detect a change in leadership.

I’m not the only one that thinks the small cap rally will continue. Here is a nice article from Dow Jones:

The small-cap stock rally is here to stay. Why these analysts say it’s bad news for the S&P 500

Provided by Dow Jones

Feb 11, 2021 10:24 AM PST

By Jack Denton

Critical information for the U.S. trading day

The Dow just scraped a record high on Wednesday while other indexes fell, led down by the Russell 2000 — the key index of stocks with a small market capitalization.

But don’t think the little guys are giving up just yet.

Our call of the day is from the financial research specialists at Leuthold Group, led by Doug Ramsey, James Paulsen, and Scott Opsal. They say that “a long-term leadership cycle” in small-cap stocks is under way — and it may be bad news for big indexes.

The Russell 2000 continues to register “ridiculously overbought” readings based on many technical factors, the researchers say, and that could be cause for market caution in the short-term. But the “extreme strength” of the index supports the Leuthold Group’s view that dominance in these stocks is here to stay.

Small-cap performance in January pushed the six-month total-return spread between the Russell 2000 and the S&P 500 above 25% for just the eighth time since 1960.

Now, here’s the kicker: In all of the seven past cases, it was only early or midway through a cycle where small-caps led stocks that the relative strength of the Russell 2000 breached the 25% mark.

That means more is likely to come, but it may not be a healthy sign for the stock market overall.

Since 1960, annualized returns for the S&P 500 were almost 6% lower when small-cap stocks have led. In fact, the researchers at Leuthold say that a portfolio of 50% cash and 50% small-caps could match the S&P 500’s volatility in the next few years while actually exceeding its return.

The backdrop of rising yields is also unlikely to derail this trajectory, the researchers say. Small-cap stocks have actually shown “a decisive performance edge” during recent periods when stock prices and bond yields moved in sync.