YTD Summary and Forecast

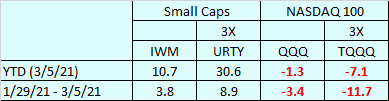

Even though it has been a brutal week, the small caps IWM and URTY are still above where they were the start of February.

When I made the call in mid November to switch to small caps, I didn’t expect Big Tech to perform as bad as it has.

Jerome Powell mentioned this week there may be some temporary inflation but nothing to worry about. The bond and stock market overreacted as usual. But once that was absorbed there was a nice turnaround Friday. The concern lately has been the rise in long term interest rates. The FED normally adjusts short term rates and has announce no plans to address long term rates. If it becomes a problem I believe they will act. They always have since the mistake they made raising rates 12/19/2018 during a market free fall, which only accelerated. They started lowering rates the following year.

The market is consolidating and coiling now and I don’t see much downside pressure. I don’t know when, but I look for the next move to be a spike up.

Thanks Mike! I appreciate the analysis.

Brutal week, but impressive YTD for IWM. Thanks, Pete from Florida