Recent Small Cap Underperformance

Nov 16, 2021, I advised I was rotating out of QQQ/TQQQ into IWM/URTY. That move paid off handsomely up to 3/12/2021. Since then, QQQ has powered ahead. I believe this is due to small caps being overbought and news of new Covid-19 variants spreading which may delay the reopening.

Is it time to switch back? I plan to stay in small caps at least through the end of 2021. My analysis is based on reversion to the mean as well as some overshoot. Small Caps favor the reopening trade and a fast-expanding economy. Here is a link to one of many articles on the topic.

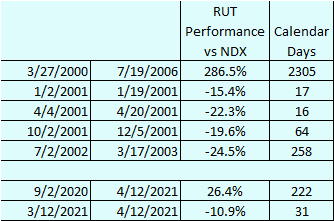

It is expected there will be some reversals in the rotation along the way. The last time small caps outperformed for a sustained amount of time was 2000 – 2007. This table shows the overall rotation with the hiccups along the way and the current rotation:

There have been larger reversals in the past, I am not too concerned about it. This is a long-term view. The Timing Pundit Ultimate signal is an overall US stock market timing signal based mostly on NASDAQ data. It does not specify what sector to be in. Normally QQQ/TQQQ is best. My rotation to small caps was a separate analysis. If you are concerned about small caps, perhaps a 50/50 allocation would have less volatility.