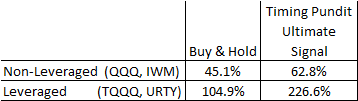

Performance summary for 2020:

I’m sure you have heard 2020 was unprecedented, and it was. The model data-set didn’t have a market with such a fast fall, recovery, and new records. But now it does. This year will only make the model better.

The Small Caps have made big gains since I made the call in mid November. You may be wondering if it is time to switch back to the big techs. My analysis indicates Small Caps could continue to out perform for 6-12 months. The only time Small Caps have outperformed for a sustained period since 1990 is when they fallen way behind the Techs and then make a rebound (2000 – 2006). 2020 is only the second time Small Caps have fallen so far behind since 1990, although not as bad as the Dotcom bubble. They outperformed 6 years last time, so it is not inconceivable they could out perform a year or two now. It will be choppy. There could be rotation back to Techs if this new Covid strain really takes off and if vaccines have distribution problems, but it should be temporary.

I have developed an indicator to tell me when to rotate back and I will publish it.

The Ultimate model went live 1/15/2020. Trades are verified by an independent 3rd party, TimerTrac.

Happy New Year and may the odds be with you.

Hello…..just curious how the performance has been YTD? I was not really keeping track. Please advise as of close on 3/25. Thanks!

YTD to 3/25/22, QQQ Long/Short Ultimate signal -0.46%. QQQ Buy&Hold, -9.62%.